Although Eddie Lack initially struggled with his transition from a professional hockey player to a full-time real estate investor, he managed to prove naysayers wrong and overcome every obstacle in his path. Now, he is a luxury home developer in Arizona. In this conversation with Ava Benesocky and August Biniaz, he looks back on his journey into hockey from a young age and the lessons of the sport he has carried over to his current profession. Eddie also breaks down his current business model, what it is like to work with investors from Canada, and how he turned his underdog status into an opportunity to grow.

Get in touch with Eddie Lack:

LinkedIn: https://www.linkedin.com/in/eddie-lack-a99762193

Website: www.eddielack.com

If you are interested in learning more about passively investing in multifamily & Build-to-Rent properties, click here to schedule a call with the CPI Capital Team or contact us at info@cpicapital.ca. If you like to Co-Syndicate and close on larger deal as a General Partner, click here. You can read more about CPI Capital at https://www.cpicapital.ca.

#avabenesocky #augustbiniaz #cpicapital

—

Watch the episode here

Listen to the podcast here

Important Links

- America One Luxury Real Estate

- Eddie Lack

- @EddieLack31 on Instagram

- @EddieLack on X

- Eddie@EddieLack.com

- Range

- Rich Dad Poor Dad

About Eddie Lack

The teamwork, skills and overall discipline to play hockey at a professional level have translated to his new career in real estate.

It’s one of the many reasons why high profile business leaders and professional athletes continue to seek him out for real estate representation.

Scottsdale is one of the best places to work and live in the world. My clients trust me because I have taken the time to really live in the area. I understand the locations and the lifestyle each unique area provides.

Knowledge, passion, discretion and integrity have been the undercurrents to Eddie’s real estate profession. His natural charisma, combined with his ability to be laser-focused on clients in a way that makes them feel like they are the only ones in the room, are just some of his many trademarks.

Eddie is widely known for his outstanding production, local knowledge and his global connections.

How NHL Star Eddie Lack Became A Luxury Home Developer In Arizona – Eddie Lack

We have a great show. We’re super excited for it.

If there are any hockey fans tuning in, this show is going to be for you.

Vancouver hockey fans, in particular, because our guest was a professional athlete and professional hockey player playing for the Vancouver Canucks at some point.

Let’s get into it. Canadians love hockey. I grew up in a small city, Fort Saskatchewan, and it was a total hockey city. We had a bunch of billet families, so all these junior hockey players were coming into town. On our weekends in high school and junior high, we were going to the rink and cheering in the stands for all of our friends. That was my life. I was like, “I want to be cool.” I played a sport called Ringette for about six years, and then I was like, “I want to be cool.” There was a girls’ hockey team. I played hockey for two years. It was fun. Girls’ hockey is a little bit slower to watch, but we had a great time.

For us who don’t understand Ringette, describe it very quickly.

Ringette is pretty much exactly like hockey, except that at the end of the stick, it’s just a stick. It doesn’t have that piece. There’s a rubber ring that has a hole in it, and you stab the ring.

You play with that ring instead of a puck.

That’s Ringette.

It’s the velocity of that thing moving around.

We’ve got to get on ice sometime, August. I told August I could skate circles around him backwards and he’s like, “I don’t know about that.”

Let’s get into the show, show. We have Eddie Lack, our guest, with us. Usually, we do a long reading of the background. Eddie has his bio here with us, but I think nothing serves it more perfectly than saying he used to be a professional athlete and a professional hockey player playing for the NHL. Now, he’s a developer building some incredible projects in Arizona and doing a few other things in the real estate space. We appreciate our guests being here. Without further ado, Eddie, welcome to the show.

Welcome to the show, Eddie.

Thank you for having me.

For the research of our show, I watched a bunch of other podcasts you’ve been on. There is a great attention put on your hockey career. We want to touch on that, but more in a sense of how you were able to leverage your background as a professional athlete, like the resilience and energy that goes into becoming a professional athlete.

Introducing NHL Star Eddie Lack

There are some stats. The number of people who try to get into professional sports, particularly hockey, and the ones that make it, the survivors, the minute percentage is mind-blowing. They’re special human beings. To also have success in this business makes you a super special person. I’ve heard from friends that if you don’t start hockey by the time you’re seven, it’s already the ship has sailed. It’s too late. Talk to us about day one. How did hot hockey come into your life? What’s the earliest memory you have from hockey? We’ll touch on it a bit more.

I started playing because Sweden won the Olympics in ‘94. I watched it on TV and everything. I was six years old at that time. I told my parents, “I want to try hockey.” Hockey school back in the ‘80s, when I was born, didn’t start until you were 7. I was born in early ‘88. They allowed me to jump up with the people and the kids who were one year older than me because I begged my way in. They have already gone through the skating school and everything for a year. I got thrown into there, and I was by far the worst player on my team because I didn’t know how to skate or anything. I started to slowly catch up.

A couple of years later, we started to introduce goalies. From the first time that I put the pads on, I felt that this was my way of belonging, fitting in, and playing as good as everyone else. I loved being the goalie. I remember from the first time, we were supposed to be rotating the goalies and stuff because everyone was supposed to try it. I showed up 2 or 3 hours before practice to make sure that I was the one who was going to play the goalie and get the pads and everything.

You started out as a goalie all the way back then. You stopped being a goalie throughout the lifetime of hockey. That’s amazing. I know some players, especially when they’re younger, try different positions. That’s incredible.

Talk to us about the NHL. How did that come about and your journey of joining the Vancouver Canucks?

I played in Sweden in the Swedish Elite League. We had finished our season there. I was 21 years old. I got a call from my agent. He was like, “The Vancouver Canucks want to sign you.” I’m like, “That’s amazing.” I knew that there was some talk with other teams before, but to have a contract in front of you, it’s like, “Wow.”

They gave me three hours to decide because otherwise, they were going to go down the list and sign someone else. I’m like, “I might as well leave.” I signed. My first contract was a signing bonus of $150,000 and I thought, “I’m going to be able to live off of this money for the rest of my life,” which is not true anymore. I signed with the Canucks, and I knew that I was going to have a few years with their AHL team before it got with The Big Club. They had Luongo and Cory Schneider. I knew that I wasn’t better than those guys.

I went over and played. Our first year was in Manitoba, Winnipeg. I bought a Canada Goose as my first purchase for that signing bonus because I need to survive the cold up there. They got their NHL team back and I played two more years in Chicago in the minor league team before I got the chance to play with the Canucks.

Embracing The Underdog Mentality

That is an incredible story. Going back to when you first started playing hockey at six years old and the group you were playing with was older than you, do you feel that having to compete with people who are better than you crafted you to always do better than the competition and try your best? Is that something that relates to your life throughout your journey?

100%. I talked to my friend Randy about this. We always talk about the underdog mentality. Even throughout my youth, my juniors, and everything, I was never the guy on the team. I was always top five on my teams, but I was never the guy that everyone was talking about to make the NHL or make the next level and everything. That made me work harder. That has translated well for me in the real estate game and stuff, too.

Being the underdog who no one talks about will inspire you to work harder. Share on XLet me tell you guys an interesting story here. There’s a lot of research done, and it’s a matter of fact. When you’re a toddler or when you are in elementary school, a few months’ age gap is huge. You grow faster or what have you. The research shows that kids who are older in their classes do much better in life than the ones that are younger. In my family, both maternal and paternal, the idea was, “Push your kids. Get them in school earlier, maybe even a year early, so they can compete against people who are better than them so that they do better.”

Athletes’ Lack Of Financial Literacy

In sports, that might be the case. For example, a lot of Eastern Bloc countries push their kids so much, and they do tremendously well in sports. In academia, being a bit older and doing better than your classmates by virtue of being older serves you better. It’s an interesting dichotomy in this topic. Continue the conversation.

A lot of times, professional athletes lack financial literacy. For example, in the US, when you talk about football, baseball, and other sports like boxing, for example, a lot of times, they come from the working class, difficult upbringings, and what have you. They lack financial literacy. A lot of times, their money “gets wasted” and what have you. They don’t have the financial literacy to be able to achieve great things.

You do see some athletes doing well. You got Michael Jordan. He could be wrong in every business decision he makes, but the money he made from Nike will carry him. A lot of athletes have done tremendously well in business and the decisions they’ve made, but a lot of other athletes don’t do well because they lack financial literacy.

Talking about your transition to real estate, which we’ll get into in detail, talk to us about your background growing up or even as an adult. What was it about, whether it be in real estate, business, or financial literacy, that helped you to transition into business? If there wasn’t and you had to learn on the job, tell us that as well.

My family has always been in real estate back home in Sweden. I hung around them early to learn from them. Even when I first started playing in the NHL and you get this bag of cash, and you’re like, “What am I going to do with this?” I made some questionable decisions early that woke me up a little bit. When I first started getting that kind of money, and this is how most people who are athletes think, I was like, “ I am just a hockey player. I’m going to focus on playing hockey. I’m going to leave the investing and the finances to someone else who knows what they’re doing.”

Doing that in the beginning by not educating myself burned me. That woke me up to, “Whatever I’m going to do, I’m going to have to have the knowledge myself to know if this is a good or a bad investment. I can’t blindly trust people to make these decisions for me. This is my money, so I need to know where this is going, and I need to know what this investment is before I commit.” Making mistakes early opened my eyes more to do more research and read. There are so many avenues out there with YouTube, books, shows, podcasts, and everything to learn. Those first couple of experiences taught me that I have to at least know what these people that I am trusting to manage my money are doing.

You must gain the knowledge to know if you are dealing with a good or bad investment. Do not just trust people blindly and allow them to make decisions for you. Share on XKeep in mind, it’s very important that you are taught to be a specialist. Especially in sports, it’s like, “Play your position. Keep focus.” That translates to life. You’re like, “I’m a specialist in what I do. Somebody else needs to figure out my finances,” which is not the case. All of us, from a young age, learn about personal finance and financial literacy.

My question is when you joined the NHL, did they introduce you to somebody, like a financial advisor, or did they have an option of investments that you guys can look at, knowing that you’re getting a signing bonus, and then as you grow your career, you’re going to be getting paid millions of dollars? It’s like, “Here you go. Here’s the blueprint.” Do they provide that to you guys in the NHL?

They don’t provide a guy or a company that you should go to or anything. It’s more like you talk around the locker room and you see what other guys are doing. They’re talking about what they’re doing and then introducing me to their guys. There are so many options and different vehicles to invest your money in. They come from teammates or from your hockey agent to introduce you to people. As soon as you start to make money, there are 25 guys who are like, “You should do this with me or this with me.” I was still 25 years old when I went up to the NHL. It’s overwhelming to know what you’re going to do.

Doing Business Across The Border

I’m going to change the topic a little bit here. I’m very curious. We’re also from Canada. We do business across the borders, and we are down in the South. When you decided to do business, Eddie, what was it that made you look down South? Why not do real estate in Canada where everybody knows you and you have a strong relationship with people? Talk to us about that. What did you see across the border?

One, my wife’s American. For me to have a work visa and everything, we had to be South of the border. When we first retired, I didn’t look at where I could make the most money. For me, it was like, “Where do I think that our quality of life will be the best? The money part will figure itself out eventually.” We looked here. We looked at California, but there’s so much traffic, taxes, and everything. We looked at Florida, too, which I know you guys are in as well. I don’t like the hurricane season. We settled on Arizona because the weather is great nine months out of the year. The taxes are low, but we still felt like it was on the way up. I knew one person when we moved here and started fresh. We’ve been here for seven years.

Luxury Home: The weather is great in Arizona nine months out of the year. But taxes are always low.

When you were down there, you wanted to be in real estate, but you also focused on brokerage. You’re doing ground-up development. You’re building some incredible projects, and you have investors. We’ll get into that. It’s your third move because you’re from Sweden and Canada. Now, you’re in the US, married to an American. You’re starting from zero again. You’re in a new industry, in which you don’t have experience. You’re not a specialist like you’ve been taught since you were six years old to be a specialist. It’s a bit nerve-wrecking. There is a little bit of anxiety there.

When you’re a hockey player, you’re on top of the world. Everyone comes to you. You don’t have to reach out to anyone, and then it completely flips because I’m selling a product and reaching out to people. The mental mindset was tough for me in the beginning. I went from going out, meeting people, and introducing myself as a hockey player, and everyone instantly respected me, to, “I’m a real estate agent,” and they’re like, “What?”

You have to sell yourself.

What Eddie’s talking about is more pride. You are an NHL player in private jets flying around the world, and people kiss the ground you walk on. The next thing you know, you’re offering a service and you have to compete with others. It’s a pride situation as well. There’s a lot of money to be made. Brokerage is a great foundation to have when you want to get involved in real estate. I always advise anybody to get into brokerage. It’s the pride of, “Is this the right move I’m taking?”

It’s such a competitive space to be in.

He enjoyed the competition. I’m speaking on his behalf, but it’s more of a pride.

It took a while for me to get over that hump, but once I realized that I’m helping people too in this space and I have a track record to show that I have helped people, that’s when the mindset shifted for me. It was hard in the beginning. I’m not going to lie.

What year is it that you transitioned from being in the NHL to your real estate career?

I’ve been doing this for about six years. We bought our first house here several years ago, and then I officially retired a year after.

How old are you, out of curiosity?

37.

Young man.

Eddie’s Financial And Business Model

Let’s get into the business model.

A transition as well. Brokerage to development. Talk to us about that. I used to be a developer. I used to build homes for a decade here in Vancouver.

Beautiful luxury homes.

I built some nice homes, not to toot my own horn. That’s where we met. That’s how I got this beautiful girl to be my wife. I built a beautiful house. She came over on our first few dates. I was like, “This is where I live.” She was like, “Wow.” I was planning to sell that house, but I was using it to say, “This is where I live.” She was like, “You live in this house all by yourself?”

He said, “Welcome home, baby.” We lived there for how long?

Four or five years. You believed in real estate, got involved in the brokerage, and got over the hump of pride. You’re offering a different type of service than your sports and athletic acumen. You’re offering a real estate service in a very competitive market. Talk to us about the transition in developing. What did you see there? Your nose for money and business probably noticed something. What did you see to get involved in development?

I tried a little bit of everything. I was part-owner of a brokerage. I was in charge of 100 agents a few years ago. I hated my life because there were calls every night with the same questions and everything. I was like, “There must be a better way to do this.” At the same time, I started doing some smaller flips myself, and then it turned more into new builds.

I’ve always said, “I want to learn on my dime. I don’t want anyone else to pay for my mistakes.” With the money that I had from hockey and everything, I had a little bit of a cushion to work with, too. I started flipping and building spec homes and everything with my own money. The daily grind of it and the type of issues that come up, it’s never the same issues over and over again. It changes, which keeps me on my toes, I feel like.

With the investors and stuff that I started to get from Canada, it wasn’t that many that wanted to buy a house here and have it wander down. It turned into, “We want to move money from Canada down to the US,” the way that the US dollar is getting stronger. That’s when I learned from being an agent to a developer. I did about 5 or 6 homes myself and then was like, “I’m starting to get the hang of this. Now I can start taking on investors’ money.” That’s what I’ve been doing for the last few years.

It’s a dynamic, fluid business. There are a lot of moving parts than being on phones, cold calling, and dealing as a broker. Being a builder and developer is a lot more dynamic. I’m sure it suits you because I enjoyed it as well. I used to be a real estate agent at some point as well, which I didn’t do well in. I did much better as a general contractor and developer.

I’m sure you got your license down there trying to do brokerage. You’re very competitive naturally because you’re an athlete. Were you looking around and seeing clients, your peers, or other brokers who were selling homes for people and seeing the margins they were making? Was that another reason you even looked at fix and flipping or developing ground-up development?

The brokerage that I’m with, my two bosses are two German guys. They started about two years before me, so they’ve always been two years ahead of me. That comes back to like the underdog mentality and everything. I’ve always tried to catch up to them. They showed me the ropes when it came to the development side and everything. I went through the trial and errors of finding the right builder for the right project, the architect, the signer, the pool guy, the landscaper, and everything.

You’re building your team. You’re bringing your players.

Once I got my team together, that’s when I felt comfortable moving to the next step. There was some trial and error in the beginning. You always think that you can save money there by using this guy because he says that he can do it for this much. You learn that eventually, the money is always around the same for these guys. If someone says that he can do it for 20% lower, that’s, in my experience, never going to be true on the far front.

If someone says they can do something for a lower price, it is never true. Share on XYou get what you pay for. That’s the old adage. It’s very true in the construction space. People always try to underbid, but then the amount of brain damage that you get as a developer hiring somebody who is 20% cheaper is not worth it many times. Sometimes, the material they use and the mess they make at the job site. You have to have your site super. That’s another layer of cost that oversees these contractors who come.

Psychology Of Dealing With Investors

You’ve mentioned a few times about your investors in Vancouver. You have this connection with Vancouver. You were playing sports. This is particularly in Vancouver because Vancouver is on the West coast. There’s a connection between Vancouver and Phoenix. A lot of people have second homes down there. They vacation down there. It’s a 2-and-a-half or 3-hour flight, I believe, so they can get there quickly. Cheap flights and cheap real estate.

Some investment firms that have done tremendously well are somewhat in trouble because they got over their skis and they were too aggressive. Overall, there’s a connection between Vancouver and Phoenix, Arizona, about investing. You also talk about investors that you have in Vancouver. I want to talk more about the psychology of being able to deal with an investor. It’s not a service you’re offering or a product. It’s more of a relationship that you’re offering. I’m wondering about you leveraging your brand and your career as an athlete.

With Ava and I, when we started CPI years ago, we didn’t have much of a personal brand to leverage. I was a builder for ten years and Ava was a real estate agent for a long time, but we didn’t have a big brand to leverage to be able to go to investors and say, “Look at my track record. This is who I am,” or, “This is the exciting person I am,” or, “I used to work for the government,” or, “I used to work for this big large private equity firm,” or, “I used to be an athlete.”

We didn’t have any of that, so we put a lot of time, attention, and focus on building a brand on ourselves, getting featured in Forbes, Yahoo Finance, speaking on stage, going on podcasts, and doing our own show. There was so much work and effort that went into building a brand for ourselves. If you Google us, a lot of information comes up. Was the journey for you to deal with investors? You’re offering a partnership to them. You’re offering a relationship to them instead of a service or a product. Was the road a bit easier because of the background you had and somewhat of a celebrity status you had, or did you have to work your butt off to get investors to partner with you?

I always say that hockey opened up the door for me, and then it was up to me to do something with that opportunity. I started the same as you guys. I focused on the social media part of it. I’ve always been big on Twitter, but I also feel like Twitter does not give me any leads, clients, or anything. My biggest thing was to build my Instagram up and the Google profile to get everyone from there.

The biggest thing for me has been word of mouth. That’s where hockey helps, too, because when I have a client that’s in Vancouver and he talks to a friend of his, he’s like, “I have an agent developer in Phoenix to refer you.” He’s like, “Who is that?” It’s then like, “It’s Eddie Lack. You saw him play for the Canucks before.” That’s where it helps for me to get my foot in the door, and then it’s up to me to do something with it.

Keep in mind, people who are investing want to have an experience sometimes. There’s a stock market where you invest. It’s up and down, and you’re watching it. Then, there’s an actual journey that Eddie probably takes and experiences. There’s the connection. It’s fun for high net worth investors. They’re like, “I’ve invested with Eddie Lack.” We feel the same thing at CPI Capital. Investors enjoy the journey of their investment as well. We could make it a little fun.

“I’m going to invest a couple of hundred thousand with Eddie Lack and make great returns. I’m going to go down to Phoenix and play some golf with him, too.”

You could go for dinner.

Developing Luxury Homes In Arizona

The last point on the projects that you are doing in Arizona, what’s your target market? Is it Phoenix or Scottsdale? Where are you building?

Scottsdale and Paradise Valley mainly. For those that don’t know, Paradise Valley is like the Beverly Hills in Arizona. It has exploded in the last few years with new builds and everything. A few years ago, you could have bought an acre for $1 million. Now, it costs you about $3.5 million for the dirt. These are $10 million to $20 million exits.

I am more focused on one area, East of that on the Scottsdale side, where you buy the acre for about $1.4 million instead of the $3.5 million. We build a slightly smaller house on it, but your exit is $5 million instead of $10 million, $15 million, or $20 million. We nailed the build, the landing, and everything down, so it comes out to about $900,000 for the entire project to make about $1 million in 18 months.

That’s the area that I feel like we’ve focused on and specialized in. That’s where I get most of my off-market deals and everything because these sellers call me directly instead of going through another agent or anything. That’s the area that I like. We have about seven builds going on there. The houses are about 6,500 square feet, so they’re bigger builds.

Luxury Home: Get most of your off-market deals so sellers can call you directly instead of looking for another agent.

You’re focusing on the luxury spec home market. That $5 million price range serves a larger number of buyers than the $20 million, for example. There’s more profit, I’m guessing, in the $20 million, but $5 million serves a larger market, so it is easier to sell. It doesn’t sit around. Do you get debt on these deals, or is it all equity?

Debt.

You get a debt, the construction loan type. As far as structuring the deal, do you usually have one investor that funds the equity or do you have multiple investors that fund it?

It all depends. Of the ones we have, there are 4 with 1 investor. There was a couple with three guys who went in together. There’s another one with a couple of guys. We structure it differently per deal. Sometimes, I throw some money in myself to go in with them and stuff as well. There are a lot of different ways to do it. The next step that I’m trying to dip my feet in a little bit is the fund way, to start a fund where people can invest anything from $1,000 to $1 million. That reaches a bigger population, I feel like.

Going back to the returns that are available, the numbers that you said, let’s say two years approximately in the worst-case scenario. One investor or multiple investors put some money in, approximately $1 million. They double their money in 24 months in the maximum way. You said 18, but let’s hypothetically say 24. Is that project level? Meaning, is that the total profit the deal makes? I’m assuming this is a GP and LP structure. Is that project level profit, or is that to the LPs?

No, it’s not. The way that I’ve structured it before is that my investor owns the land, and the construction loan is all in their name and everything. I take a development fee, and that’s included in the build costs and everything. Of the million that they make, the only thing that they have to pay off is the taxes. There are no other fees or anything to it.

You’re somewhat of a service provider. You’re getting your fees for the services you provide. You don’t touch any of the upside that the investor makes. In our space, the way that we structure our deal is we charge fees, acquisition fees and asset management fees, but then we also participate in the upside. We make it performance-based so we have a vested interest in the deal to do better because we’re getting a piece, usually 30% of the upside. It motivates us to make sure the deal does well. In your case, you want the deal to do well because you want these investors to keep investing with you. This was great information. We’d love to come down to Scottsdale and see you as well. Do you have any other questions, Ava, before we get to the second segment of our show?

Let’s get to the second segment.

Let’s do it.

10 Championship Rounds To Financial Freedom

Ten championship rounds to financial freedom. We’re going to ask you a series of questions. Are you ready?

Yes.

Let’s do it. First question, Eddie. Who’s been the most influential person in your life?

My dad. He helped me with hockey and everything. He showed me how to be a man again. My dad has been the most influential.

Next question, what’s the number one book you’d recommend?

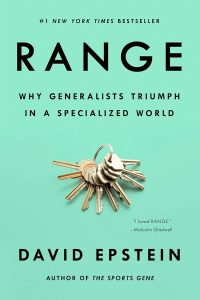

We talked about it before. The Rich Dad Poor Dad book is such a great book that goes through generations, and it still works. That would probably be my number one book. I am reading one that’s called Range. It talks about kids who specialize in a sport or something early compared to kids who try everything when they’re young. That’s an interesting book that I’m reading, too.

Which one is better?

What’s the thesis?

The specializing one seems to do better. From my personal experience, I don’t agree, but that’s what the stats say.

Good to know. We should read that because we have two sons. Next question, if you had the opportunity to travel back in time, what advice would you give your younger self?

I would travel back in time and invest more of my money in real estate while I was still playing. I tried the stock market, the life insurance route, and everything. I feel like real estate is something that I know myself. That’s what I would invest in more of earlier in my life.

Good advice. Next question, what’s the best investment you’ve ever made?

That’s probably one of the last builds that we did. That was in Paradise Valley. It was a good return.

That’s amazing.

Lucky investors.

What’s the worst investment you’ve ever made, and what lessons did you learn from it?

It was probably one of my first builds because it was the wrong GC. It was the wrong everything. The whole project cost probably twice as much as I thought it would, and it took twice as long as it should have.

The next question is, how much would you need in the bank to retire? What’s your number?

I am very bougie. If I have $20 million in investments, then I would retire.

That’s a nice number. Sometimes, people say numbers on the show, and I’m like, “How could you live off of that?”

It’s very achievable and I’m like you, “You haven’t made that yet?” We’ve had other big numbers as well.

We like to travel and everything, too. It’s not like I’m going to retire and sit and stare at a TV for the rest of my life. I still want to go places, experience things, and have houses and everything around the world.

I love it. That’s awesome. Next question is, if you could have dinner with someone dead or alive, who would it be?

This is supposed to be Rapid-fire, but I would like to have dinner with Donald Trump and see what the heck is going on in his mind with everything that’s going on with the tariffs and where this country is going. There are so many questions that I have. It’s him that I would pick.

Nice one.

Is Arizona blue or red?

We were red for this past election, but we have a blue governor.

It’s all those California people moving there.

Eddie, if you weren’t doing what you’re doing, what would you be doing?

I would’ve probably stuck within hockey with something, like a coach, a scout, or a GM. I’d probably stick with hockey because I still love the game.

This is my favorite question. Book smarts or street smarts?

Street smarts, but you need both.

This is the last question, Eddie. If you had $1 million in cash and you had to make one investment, what would it be?

We talked about the million. That’s what I would do with our spec homes and stuff. I would throw it in there, and then in 18 months, you have $2 million to do something fun with.

Thank you so much for sharing your background, your story, and what you’re doing. We’re excited to watch you grow and come and see you in person.

What’s the best way that people can reach you if they want to reach you?

My email is Eddie@EddieLack.com. My Instagram is @EddieLack31. Twitter is @EddieLack. Reach out.

Thank you so much. This was a fantastic show.

Thanks for being here, Eddie.

Thank you.