Dear valued existing investors and future investors,

Welcome to CPI Capital’s regular news briefing.

Our frequent newsletters contain a mixture of updates, commentary and informative articles about the lucrative world of passive real estate investment.

If you are already one of our subscribers, thank you. If not, you can sign up to our newsletter now and keep up to date with all you need to know about syndicated multifamily real estate investment!

SIGN UP HERE to receive details of our investment offerings

Whether you are an active or passive investor in multifamily real estate, here is an important question asked by many:

What is the correlation between bond yields and real estate cap rates?

Another frequently asked, secondary question, is:

How do interest rates and bond yields affect the performance of real estate investments?

To begin to answer these questions, it is necessary to understand the relationship between bond yields and capitalisation (cap) rates, namely: two fundamental measures of risk and investment return, one in the fixed-income world, the other in real estate such as syndicated multifamily.

The two Key Terms

Bond Yields: are the returns investors receive from fixed-income securities such as government or corporate bonds. The yields on bonds typically rise when interest rates go up, but fall when interest rates decline;

Cap Rates: a metric used in real estate to estimate the investment return on an income-producing property. A cap rate is calculated by dividing a property’s net operating income (NOI) by its purchase price. A higher cap rate generally implies a greater investment return, but also carries higher perceived risk.

The Relationship between Bond Yields and Cap Rates

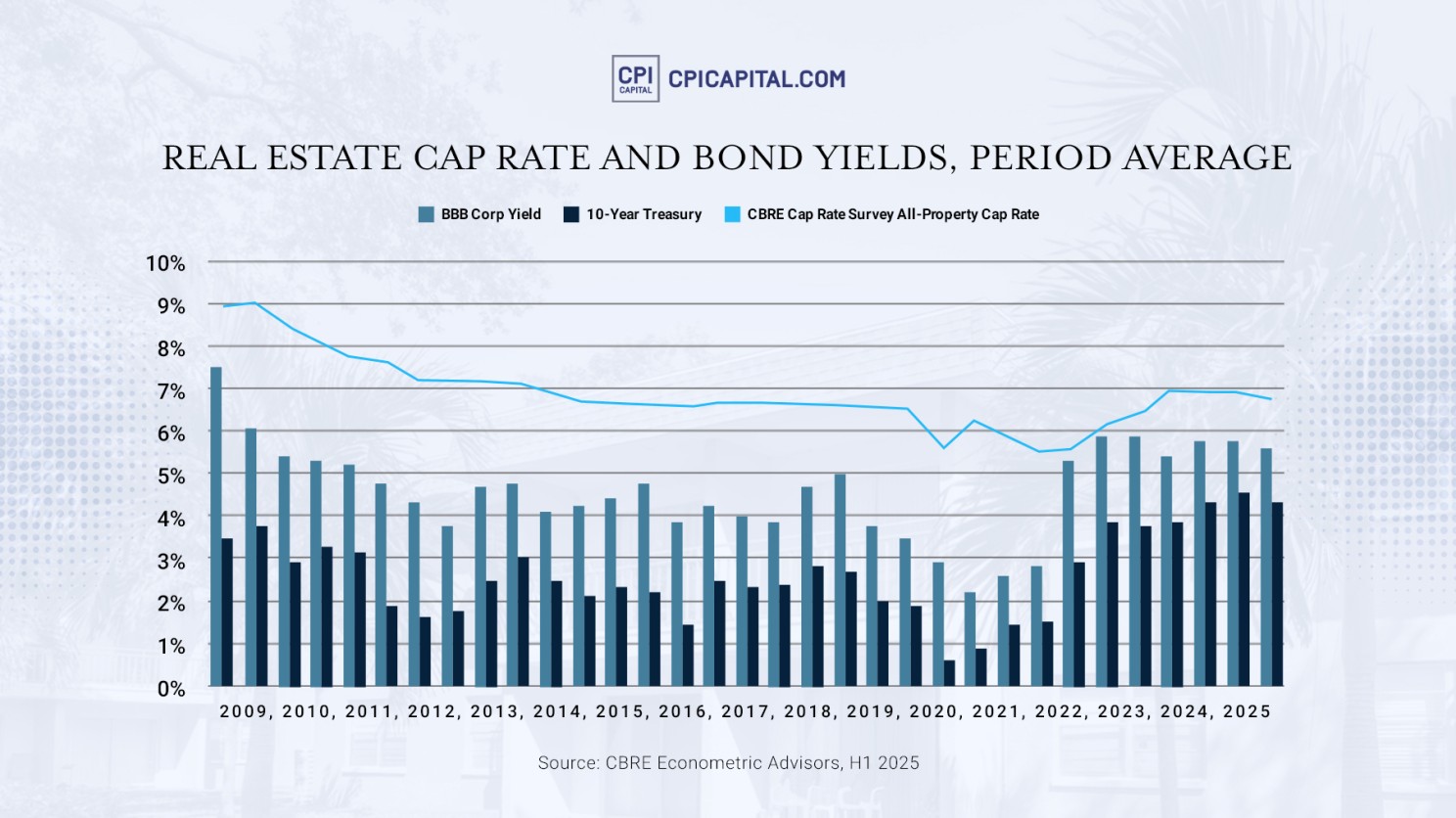

Although not always perfectly aligned, historically, there has been a correlation between bond yields and real estate cap rates.

Some of the key reasons for this include:

- Risk Premium

Real estate investors often compare cap rates achieved in multifamily or other real estate investments to the so-called “risk-free rate” — in many cases, the yield on long-term government bonds (10-year Treasury yield)

As one would expect, investors require a “spread” (or premium) above this risk-free rate to compensate for the additional risks involved with investing in real estate.

Such risks may include, for example, illiquidity, property management issues, tenant turnover and associated void periods, and the fluctuations of market cycles.

- Flows of capital

When bond yields are low, investors often seek higher-yielding assets such as multifamily real estate. Higher demand for property assets pushes property prices up and, consequentially, cap rates down. Conversely, when bond yields rise, real estate competes with safer fixed-income investment returns, often pressurising cap rates to rise to compensate for this.

- Financing Costs

When bond yields rise, they usually indicate higher borrowing costs are likely. As interest rates climb, financing property acquisitions becomes more expensive. This reduces investor appetite for paying premiums on assets, taking cap rates lower.

Yet the Correlation between Bond Yields and Cap Rate is Imperfect

Although bond yields and cap rates generally move in the same direction over time, the correlation is not necessarily in tandem.

Several factors can create divergence:

- Supply and Demand for Real Estate: market fundamentals (supply of new properties, tenant demand, vacancy rates etc) can keep cap rates steady even if bond yields rise;

- Investor Sentiment: in times of uncertainty, many investors still view real estate as a safe haven, keeping demand high and cap rates compressed;

- Global Capital Flows: international investors may target Canadian or US real estate for asset diversification, such demand affecting cap rates irrespective of domestic bond yields.

The “Spread”

In order to justify the additional risks involved, real estate investment returns must be higher than those from bonds. But by how much?

As the difference is not one single figure, the relationship between bond yields and cap rates is usually described as a “spread” (or a range).

Historically, such spread has ranged from between 250 to 500 basis points (2.5%–5%), although it fluctuates with economic cycles. When Treasury yields fell sharply in 2020/21, the spread was very wide. Real estate was considered more attractive as financing was cheap and alternatives were yielding almost zero.

As interest rates and yields rose above 4% between 2023 and 2025, cap rates started increasing, but much more slowly. The risk premium compressed, meaning a lower differential return over the risk-free rate.

Over many decades, cap rates for multifamily have historically outperformed the 10-year Treasury yield by a spread of around 215 basis points (2.15%) on average.

Download and read our FREE e-book: 25 Fundamental questions to ask a Syndication Sponsor before making your investment

CPI Capital understands that bond yields and real estate cap rates are interlinked through factors such as risk premiums, capital flows and financing dynamics. Even though not perfectly correlated, their interplay shapes property valuations and investor returns — making them essential indicators for anyone investing in syndicated multifamily real estate.

Fundamentally, it’s clear that:

(i) real estate can remain a viable income-producing investment even when bond yields rise, as long as the spread is wide enough to warrant the added perceived risk;

(ii) such spread helps determine the amount real estate investments “pay” relative to risk-free securities;

(iii) when spreads are marginal (that is, cap rates are only just above Treasury yields) underwriting must be more conservative; therefore acquisition returns or appreciation risk may be lower.

CPI Capital’s investment teams monitor the various factors which affect bond yields and real estate cap rates on a daily basis to ensure that our real estate investments achieve the optimal returns.

Yours sincerely,

August Biniaz

CIO, CPI Capital

Ready to build true wealth for your family?

It all starts with passive income. Apply to join the CPI Capital Investor Club.

Search

Recommended

The Sunk Cost Fallacy In Active Real Estate Investing: Embracing The Power of Multifamily Syndications

Dear valued existing investors and future investors, Welcome to this week's CPI Capital's news...

Key Metrics Every Multifamily Investor Needs to Know

Dear valued existing investors and future investors, Welcome once again to this week’s CPI...

A Beginner’s Blueprint to Multifamily Real Estate Investing

Dear valued existing investors and future investors, Welcome once again to this week’s CPI...